Effective April 1, 2018, the JD(S)/Congress coalition government in Karnataka notified revision of minimum wages, which has triggered a big debate in the state. Here’s all you need to know about the move, which has created furore.

What is percent wage Increase?

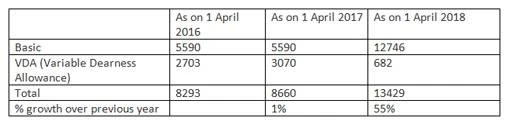

As per the notification, minimum wages went up across the board. The table below explains the extent of increase for the role of typist/data entry operator for Zone 1 (Bengaluru). The figures are in rupees per month.

The basic minimum wages are fixed every 3 to 5 years, while the VDA changes every 6/12 months. The basic wages were revised for this role on 1 April 2012 and thereafter the increase was only in VDA, which is supposed to correct for inflation. The basic wages were revised in 2018, wherein part of the VDA was also included. But the total salary increased by 55 per cent, as compared to 1 per cent increase the previous year. The increase in other roles is also significant – upwards of 30 per cent.

Code on Wages (CoW) Bill controversy

This increase comes in the context of the recent Code on Wages (CoW) bill presented in the parliament on 10 Aug 2017, by the then minister of State for Labour. This bill, yet to be passed by the parliament, was part of the BJP government’s labour reform, which tried to set a National Floor Level for Wages (NFL) and National policy on minimum wages that are actually administered by the individual States. CoW attempts to rationalise and revise minimum wages upwards and created a lot of reaction from the employers, who thought (mistakenly) the National Floor Wage would be over Rs 21,000 per month. It was later clarified that the NFL was not specified in the CoW bill. Incidentally, the minimum wage for a government employee was revised from Rs 18,000 to Rs 21,000 per month, recently. But the minimum wages for employees in private employment are far lower and despite that most employers beat the system by paying even less than the minimum wages

Why Karnataka?

But before we discuss Karnataka, we must discuss Delhi. AAP Government scored the first goal for minimum wage increase. According to the March 3, 2017 notification, the minimum wages for an unskilled worker went up from Rs 9,724 per month to Rs 13,350, an increase of 37 per cent. The semi-skilled wages went up from Rs 10,764 to Rs 14.698 per month, an increase of 36.5 per cent. This, however, was stuck down on the 4th August 2018 by the Delhi high court, as the employers went to the court and claimed that they were not consulted adequately.

Karnataka has followed the Delhi AAP game plan to significantly increase the minimum wages. And it is a political gamble by the government. Karnataka was anyway struggling to attract youth to non- IT jobs because the IT industry sets very high salary standards. So the big revision is a far easier matter for Karnataka than a state like Uttar Pradesh.

A big upward revision in minimum wages is long over-due

The graph plots the wages of the average factory worker. Nominal wage rate reports a steady growth. But the real wages appears to be stagnant Rs. 45,000 per annum over a 12 year period

A research paper published By Prof Bino Paul et al in Economic and Political Weekly (July 26, 2014 issue), revealed that the average factory worker’s compensation – net of inflation – remained constant or was reduced, during the 12 year period between 1999 and 2012. During the same period, supervisor and managerial compensation went up by 200-400 per cent. Employers diverted the labour compensation to managerial compensation, because of demographics. Supply of unskilled and semi-skilled work force is far more than the demand. This is the reason, why employers could manage to keep the minimum wages very low and even managed to pay less than the minimum wages. The demographic dividend is working against labour.

The minimum wages upward revision is essential for the skill movement.

In fact, the skill movement in India has suffered due to low minimum wages because it is not attractive to get skilled. On top of this, the skill premium – the difference in wages between unskilled and semi-skilled – is very low. For example, even under the new Karnataka Minimum Wages Notification for Shops and Establishments, the semi-skilled will get only Rs 45 per day (9%) more than the unskilled. So where is the incentive to get skilled?

Why now?

As it is elections time. For example, on August 8, 2018 ‘Beedi’ workers staged an indefinite strike in Mangalore demanding the implementation of the minimum wages in ‘Beedi’ industry. Clearly, AAP and the coalition Government in Karnataka, would want to beat BJP in their game. Also minimum wages revision will also impact the MNREGA pay outs, and hence will have a huge rural and urban poor support. This means more votes in the next parliament elections.

What are implications for the rest of India?

The first party to propose the minimum wages increase was the CPM in its manifesto released in August 2014, which stated, “A statutory minimum wage of Rs. 10,000 per month linked to Consumer Price Index” is mandatory.” Centre of Indian Trade Unions (CITU) has been demanding a minimum wage of Rs 15,000. After AAP and Congress/JDS coalition, all other parties will have to follow suit and I expect the BJP national government to also join the bandwagon. The Karnataka model will be adopted by all parties. The larger companies will make some noise, but will adopt it, because they have no choice and will start looking at productivity improvement and automation to compensate for the increase in costs. The MSME sector will be impacted. Those who can manage the local compliance authorities will get away by paying less than the minimum wages. Those who want to comply in MSMEs will suffer. The only solution is to provide Skill Wage Incentive (SWI) to MSMEs to compensate up to 25 per cent of the salary for all new employees for the first three years. Already the Central Government has started National Apprentice Promotion Scheme (NAPS) under which employers are paid directly Rs 1,500 per month for 12 months as an incentive. Central government is paying 12 per cent EPF contribution of employers for all new employment in the next three years. Hence, the MSME Skill Wage Incentive can be easily be implemented on similar lines and hence is a must for MSME compliance.